Kasey Nored

Excel!

So... I bought a house this summer, and it needs some work.

Exhibit "A" The house.

The work the house needs ranges from painting to redoing the floors and some minor construction stuff, such as a creating a back door as the house does not have one. It has three front doors and no back door.

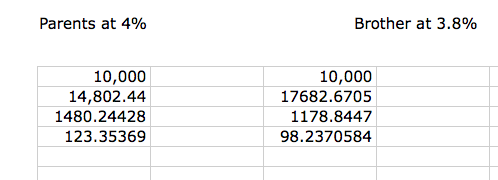

It's looking like my expenses will be something like 10,000. I have two options. Borrow the 10,000 from my brother at 3.8% interest compounded continuously and pay back over 15 years or borrow the 10,000 from my parents at 4% interest compounded yearly and pay back over 10 years with no penalties on either loan. So, who should I borrow from?

After looking at the numbers it seems that the payment to my brother will be lower each month but will cost me much more over the life of the loan.

Can I swing an extra 25 dollars a month to save myself 2,800 dollars? I think so. Sorry Bro, I'm taking mom and dad's offer!!